Irs w on sale 4 calculator

Irs w on sale 4 calculator, IRS finalizes new W 4 to help taxpayers correct withholding Don on sale

$0 today, followed by 3 monthly payments of $14.33, interest free. Read More

Irs w on sale 4 calculator

IRS finalizes new W 4 to help taxpayers correct withholding Don

Understanding your W 4 Mission Money

How to Use the IRS Withholding Tax Estimator for Form W 4

united states How to Answer IRS Withholding Calculator Questions

W 2 and W 4 What They Are and When to Use Them

Updated Withholding Calculator Form W 4 Released Priority One

timothyloest.com

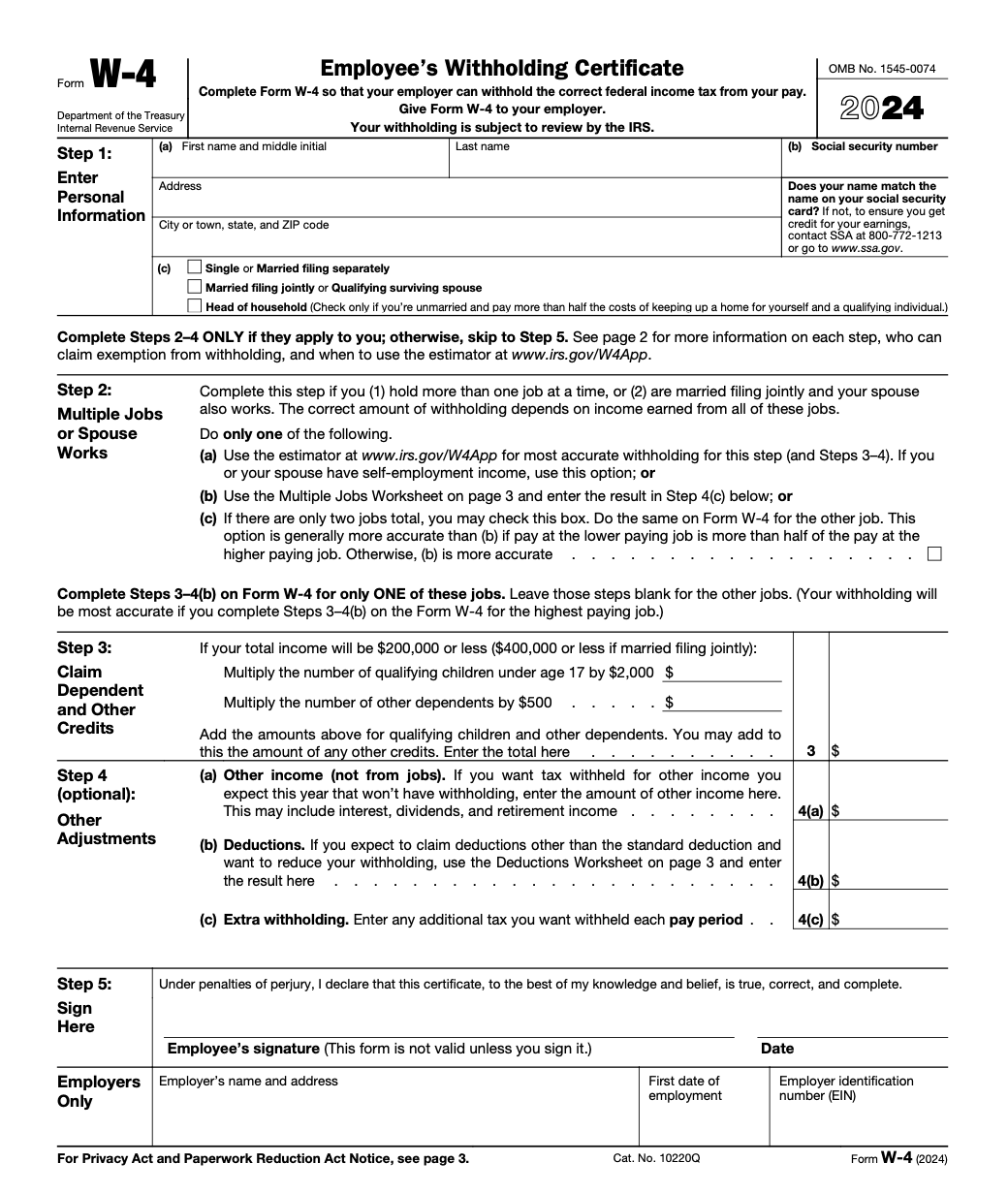

Product Name: Irs w on sale 4 calculatorIRS Improves Online Tax Withholding Calculator CPA Practice Advisor on sale, How to Use the New IRS Withholding Calculator on sale, IRS RELEASES NEW FORM W 4 AND ONLINE WITHHOLDING CALCULATOR on sale, Learn about the new W 4 form. Plus our free calculators are here on sale, How to Fill Out Form W 4 on sale, W4 Calculator CFS Tax Software Inc. Software for Tax on sale, Withholding calculations based on Previous W 4 Form How to Calculate on sale, Updated Income Tax Withholding Tables for 2024 A Guide on sale, Instructions Tips to Help You Fill Out Submit a W 4 Form on sale, W 4 Calculator Automated Software Program EZ W 4 on sale, What Is Form W 4 on sale, How to Calculate Federal Income Tax on sale, W 4 Guide to the 2024 Tax Withholding Form NerdWallet on sale, IRS Tax Withholding Estimator IRS Tax Calculator 2023 on sale, How to Complete Form W 4 on sale, united states How to make sense of results from the IRS W 4 on sale, Test Your Knowledge of the IRS Tax Withholding Estimator BDS on sale, IRS Form W 4 Free Download on sale, IRS finalizes new W 4 to help taxpayers correct withholding Don on sale, Understanding your W 4 Mission Money on sale, How to Use the IRS Withholding Tax Estimator for Form W 4 on sale, united states How to Answer IRS Withholding Calculator Questions on sale, W 2 and W 4 What They Are and When to Use Them on sale, Updated Withholding Calculator Form W 4 Released Priority One on sale, Using the IRS Withholding Estimator Taxing Subjects on sale, Tax Withholding Definition When And How To Adjust IRS Tax on sale, IRS Tax Withholding Estimator Helps Retirees Workers and Self on sale, IRS Releases New Draft Form W 4 To Help Taxpayers Avoid on sale, Adjust Your Withholding to Ensure There s No Surprises on Tax Day TAS on sale, How To Fill Out a W 4 Form in 5 Helpful Steps With FAQs Indeed on sale, What Is the W4 Form and How Do You Fill It Out Simple Guide on sale, IRS Releases Updated Withholding Calculator And Form W 4 For 2018 on sale, Mobile FarmWare IRS Form W 4 2020 on sale, What is a W 4 Form on sale, How to Calculate Withholding Tax as an Employer or Employee AMS on sale.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Irs w on sale 4 calculator

- irs w 4 calculator

- curta calculator

- effective interest rate calculator

- calculator app lock

- loan rate calculator

- shift calculator

- unit conversion calculator

- multiplication calculator

- amps to kva

- estimate my tax return